스포트라이트

Corporate Finance Analyst, Financial Analyst, Investment Banking Associate, Mergers and Acquisitions (M&A) Analyst, Capital Markets Analyst, Corporate Development Analyst, Private Equity Analyst, Venture Capital Analyst, Equity Research Analyst, Investment Banking Associate

An Investment Banker works for an institution dedicated to making money from securities investments. Companies use these Investment Banks to sell their stocks which helps the company make money. Investors use the banks to help buy these stocks. The Investment Banker advises the companies on the best securities to issue, how best to price them, and underwrite security investment.

- Excellent compensation, with bonuses.

- Easy to see growth from strong efforts.

- Your success is easily visible and well respected.

Base salaries for 1st, 2nd, and 3rd Year Analysts at large banks are $85K, $90K, and $95K, with year-end bonuses between 70% and 100% of those numbers (lower percentages in earlier years and higher toward the end).

Average total compensation ranges might be $140K – $160K, $160K – $180K, and $180K – $200K for 1st, 2nd, and 3rd Year Analysts.

Investment Bankers work long hours in an office setting. The position is considered stressful, but rewarding. You can expect to work close to 100 hours a week at times – possibly more. During a typical day, you can expect to:

- Attracting new clients through sales books.

- Creating “pitchbooks,” or books used to attract investors.

- Prepping offers for clients and investors.

- Preparing projections for investments.

Much of this work is done via email, phone calls, meetings, and text message. Much of the morning is spent preparing for afternoon meetings with clients to determine final deals. In the evening, they spend much of their time with publishing experts to revise and rewrite marketing materials.

소프트 스킬

- 스태미나

- 사회적 기술 - 구두/서면 커뮤니케이션

- 창의성

- 분석 기술

기술 역량

- 워드 프로세싱, 스프레드시트, 데이터베이스 및 이메일용 오피스 소프트웨어입니다.

- 데이터 분석 소프트웨어 이해.

- Knowledge of the stock market and events that may cause a rise or fall.

- 고급 비즈니스 지식과 투자자 유치 방법

An Investment Banker will work long hours, especially at an entry level. Days typically do not start until 10am, but can last until 2am or later. You will need to have a busy internship and attend a prestigious school. Investment Banking is one field where your school name will matter. Banks often will come to the schools to recruit new employees.

There is not much room for a social life as an Investment Banker. You can expect late nights as well as eating meals in the office frequently. Some weeks may be less intense than others, but there will not be much predictability to this. It is a go-go-go industry. If you enjoy working in a fast-paced, constant environment, you may find the high salary and prestige a fair compensation.

As with other financial careers, there is a growing emphasis on data analysis and technology. With centuries of financial data and stock charts to analyze, financial analysts will be able to better determine patterns in the markets and figure out the best way to raise capital for their clients.

New opportunities such as Cryptocurrency are also disrupting markets. This newer security (an alternative currency) is still being studied for money-making opportunities.

- Selling in yard sales and helping with fundraising.

- Working with math problems.

- Scorekeeping for sports teams.

- Doing deals

- 투자에 관심 있으세요?

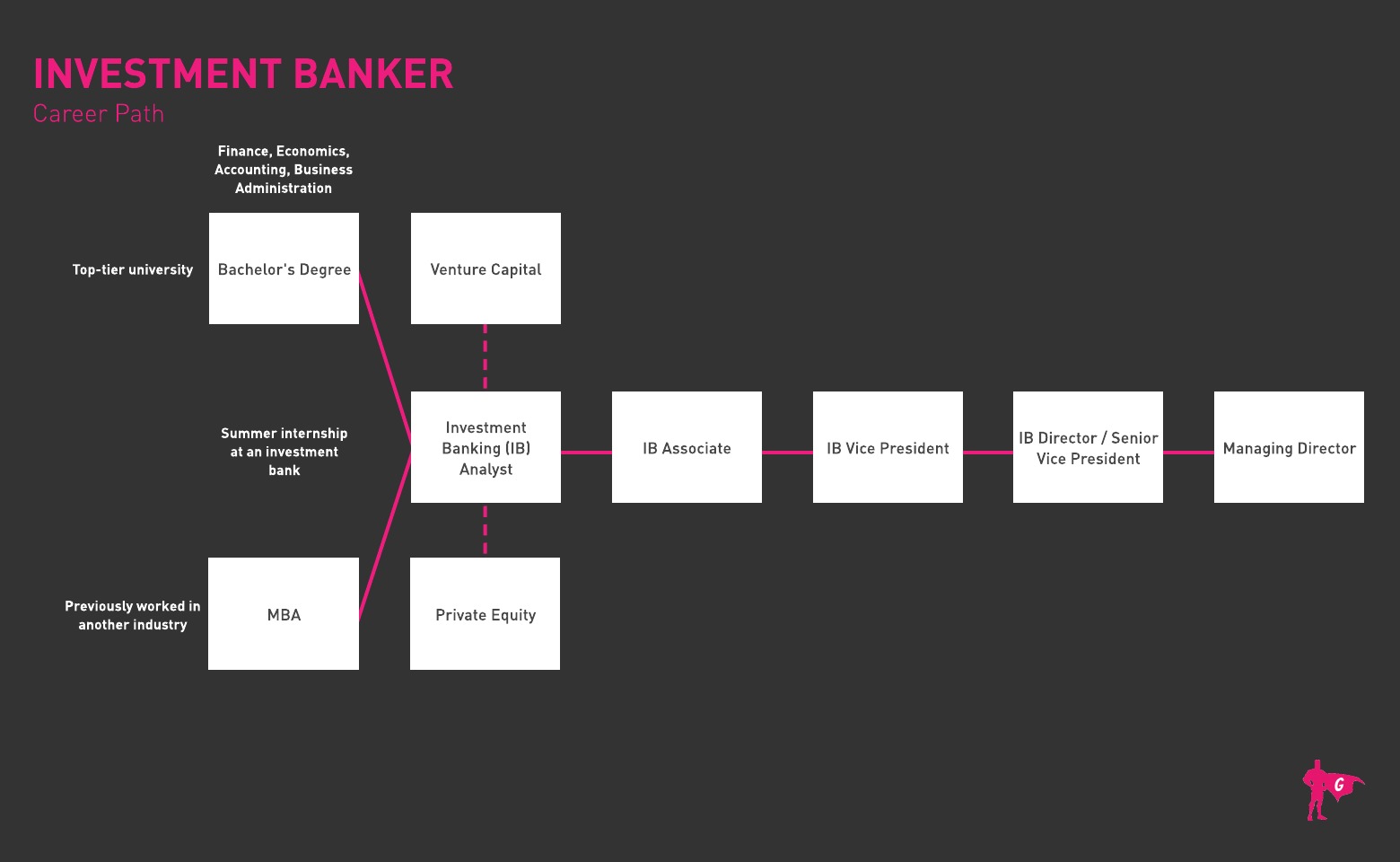

- Investment Bankers need at least a bachelor’s degree in finance, business, or economics

- Completing an MBA isn’t necessary for all jobs, but does make you more competitive and could qualify you for a higher starting salary

- Beyond academic education, practical education via work experience is preferred and can be gained through internships

- Note, Investment Bankers handle large financial deals and can earn a sizable income. As a result, banks don’t just look at what degree you have, but which school you graduated from

- Peak Frameworks’ Investment Banking Target School List (Using Data) offers invaluable insights into which schools are ideal for this career field

- Investment Banking professionals may be expected to pass certain Financial Industry Regulatory Authority (FINRA) exams before or during their careers, such as:

- Series 7 - General Securities Representative Exam

- Series 63 - Uniform Securities Agent State Law Exam

- Series 79 - Investment Banking Representative Exam

- Enroll in plenty of math, accounting, finance, statistics, analytics, economics, and banking classes

- Develop your written, public speaking, and presentation skills

- Volunteer as a budget officer with school clubs or other organizations

- Get in plenty of hours studying to prepare for the long work weeks of this profession (Investment Bankers may work from 60 to 100 hours a week during busy times)

- Apply for Investment Banker intern jobs to gain much-needed work experience

- Request informational interviews with experienced Investment Bankers who are willing to answer questions

- Consider adding a professional certification to your education, such as New York Institute of Finance’s Investment Banking Certification

- Craft a compelling LinkedIn profile and stay connected with people in your network

- This is a highly competitive and lucrative field, and many candidates graduates from top schools, have MBAs, certifications, or other academic edges.

- Investment banks usually recruit on campus at the most prestigious universities for summer associate positions. This usually occurs the fall semester of your junior year.

- You will need good grades to get an interview.

- Your summer associate internship will occur during the summer of your junior year and by fall of your senior year, if you did a good job, they will give you an offer for full-time position for the following fall.

- Expect to start as an Investment Banker analyst for a couple of years or more

- Many Investment Banker internships can roll into full-time employment, so those are a great starting place if you haven’t already done one

- Remember, Investment Bankers work exceedingly long hours, and interns may work even longer! This is a major lifestyle commitment you must be serious about and ready for

- Decide if you want to work for a bulge bracket or a boutique investment bank

- Figure out where you want to work — many large investment banks are based in New York, but there are also hubs in Boston, San Francisco, Los Angeles, London, Zurich, Singapore, Dubai, Sydney, Tokyo, and Hong Kong

- eFinancialCareers, 금융 잡 뱅크, 인디드, 심플리 히어드, 글래스도어, 금융 전문가 협회 채용 게시판과 같은 취업 포털을 통해 기회를 찾아보세요.

- Inform your professional network that you’re looking for work! Many job tips come from people you know

- Pack your resume with specifics to include stats, dollar figures, impacts, and keywords such as “investment banking, “valuation, “financial modeling, “mergers & acquisitions (m&a),” corporate finance,” financial analysis,” “investments,” and “capital markets”

- Check out Investment Banker resume examples for ideas

- Consider hiring a professional resume writer to polish your work and ensure it is clear and error free

- Study common interview questions to plan ahead for what you’ll say

- This website does a great job of telling you how to break into investment banking: https://www.mergersandinquisitions.com/how-to-get-into-investment-banking

Go to this link for a complete guide to a career in investment banking: https://www.mergersandinquisitions.com/investment-banking-career-path/

웹 사이트

- American Bankers Association

- Bank Administration Institute

- Bank Policy Institute

- Barron's

- Consumer Bankers Association

- Dealbreaker

- 신탁 및 투자 위험 관리 협회

- 금융 산업 규제 당국

- 파이낸셜 타임즈

- Independent Community Bankers of America

- Mortgage Bankers Association of America

- National Bankers Association

- National Investment Banking Association

- 성벽의 거리

- 월스트리트 저널

도서

뉴스피드

주요 채용 정보

온라인 강좌 및 도구

연봉 기대치

신입 직원의 초봉은 약 $76,000입니다. 중간 급여는 연간 $99,000입니다. 고도로 숙련된 근로자는 약 $129,000를 받을 수 있습니다.